Georgia's Governor Pushes For A Stimulus Check & Here's How You Can Get $500 And A Tax Relief

Getting just a portion of it is easier than you think.

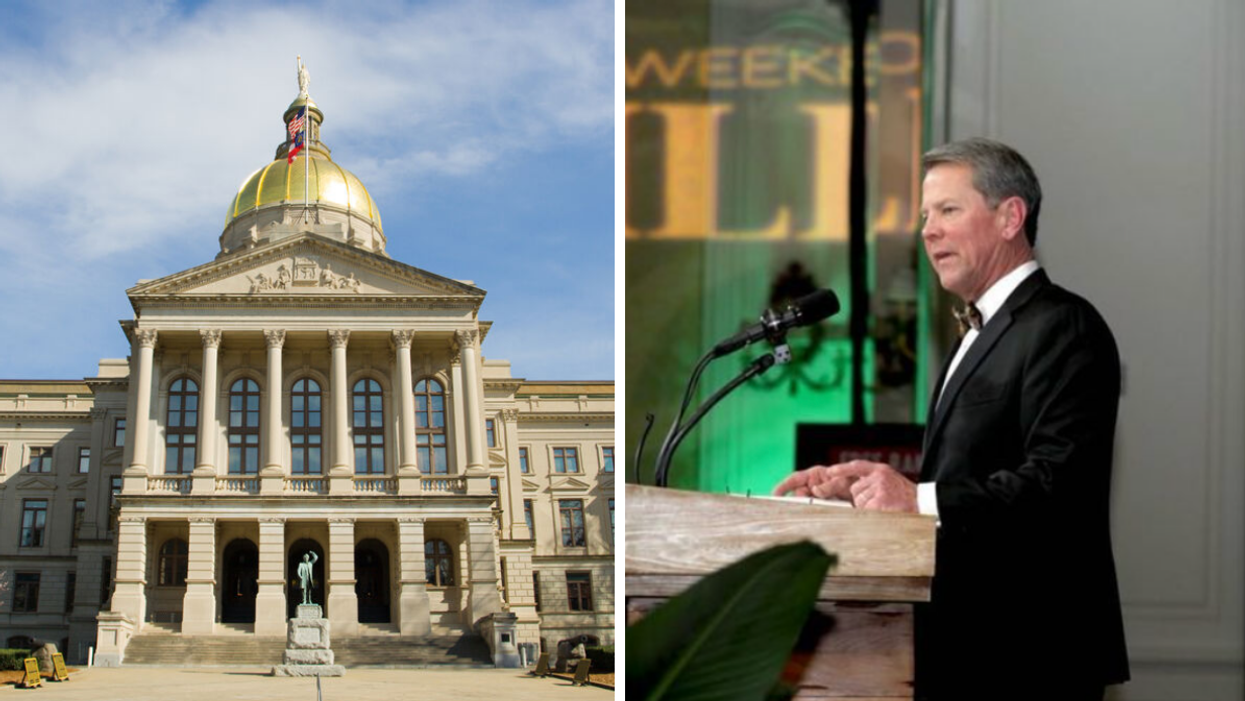

The Georgia Capitol building. Right: Georgia Governor Brian Kemp.

At the start of the year, Georgia Governor Brian Kemp assessed the state's budget and gave his recommendations on how to distribute it. Two proposals could provide different stimulus checks for Georgia residents under specific qualifications.

He proposed a one billion dollar state income tax refund. The purpose is to give every single taxpayer a cut of the money and ease the impact of U.S. inflation. Those who filed as individuals can make $250 and those who filed jointly can make $500.

Governor Kemp pushed for these stimulus checks last year, as well. It was passed in March 2022 under House Bill 1302. This year, they are hoping to get that bill renewed in the current session for 2022-2023.

That's not all.

The governor also suggested a one-time Homeowner Tax Relief Program worth $1.1 billion. You can also get a property tax relief of on average $500 if you're an eligible homeowner.

He made these proposals on January 13 to the General Assembly, and, according to Georgia's General Assembly calendar, leaders are meeting under the Golden Dome in Atlanta today. The Senate passed the previous bill around this time last year, so a verdict on Governor Kemp's recommendations can be expected soon.

Kiplinger reported that other states that jumped on the bandwagon in 2022 are still sending out their tax rebates in 2023. These states include California, New Jersey and South Carolina.

Last year in the Peach State, the checks were expected to automatically hit your account if you successfully filed your taxes and are a Georgia resident.

It seems you can expect the same for this year if Governor Kemp's proposals are approved.